Recently, mobile loan apps have revolutionized the financial sector, providing a lifeline for individuals seeking quick and hassle-free access to credit.

These apps have served as a bridge between traditional financial institutions and the underserved, providing them with fast and convenient services. A

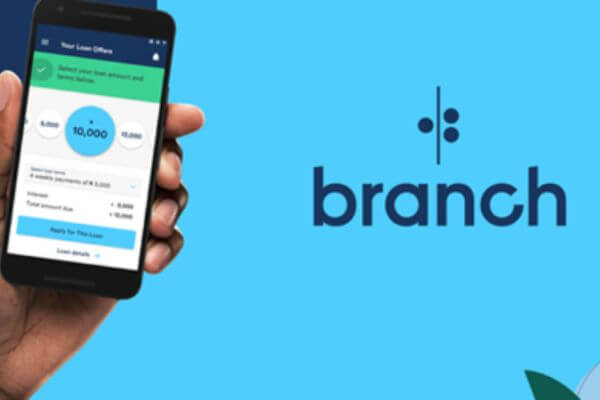

mong the leading platforms in this space is the Branch Loan App, which has gained global recognition for its seamless loan process and user-friendly features.

This article explores the Branch Loan App in detail, focusing on its requirements, interest rates, and application process, providing a comprehensive guide for potential borrowers.

Overview of Branch Loan App

The Branch Loan App is a mobile-based lending platform designed to offer instant credit to users without the need for collateral or extensive paperwork.

Established to promote financial inclusion, the app operates in multiple countries, including Nigeria, Kenya, Tanzania, India, and Mexico. Its advanced use of technology, particularly AI-based credit scoring, sets it apart, making it one of the most trusted names in mobile lending.

Branch distinguishes itself through its simplicity and efficiency. The app evaluates users’ creditworthiness based on smartphone data, including transaction history, SMS records, and behavioral patterns, rather than relying on traditional credit scores.

It is accessible to anyone with a smartphone and minimal documentation, making it particularly beneficial for the underbanked population. Additionally, its fast disbursement of funds—often within minutes—adds to its appeal.

Eligibility Requirements for Branch Loans

Basic Criteria

To qualify for a loan on the Branch app, users must meet specific criteria. Borrowers must be at least 18 years old, though the upper age limit may vary by country. The service is typically restricted to residents of countries where Branch operates, such as Nigeria, Kenya, and India.

Financial Requirements

Applicants must have an active bank account or mobile wallet linked to the app, as this is where loan disbursements are made and repayments are collected.

Additionally, a steady income source, whether from employment or business transactions, is often required. A positive borrowing history or a good credit rating enhances the chances of approval.

Documentation Needed

The Branch Loan App requires minimal documentation, which is part of its user-friendly appeal. Borrowers typically need to provide a valid government-issued ID and, in some cases, proof of income, such as bank statements or transaction histories.

These requirements make the app accessible to a wide range of users, including those without extensive financial records.

Interest Rates and Loan Terms

Interest Rates

The interest rates on Branch loans vary depending on factors such as the borrower’s creditworthiness, loan amount, and repayment duration. Rates typically range from 1.5% to 20% per month.

While these rates may be higher than those offered by traditional banks, they are competitive in the mobile lending space, given the convenience and speed of the service.

Loan Terms

Branch offers flexible loan terms tailored to the borrower’s needs. Loan amounts can range from as low as $10 to several hundred dollars, depending on the user’s credit limit.

Repayment periods are also flexible, often ranging from four weeks to several months. Borrowers are informed of the repayment schedule, total interest, and any applicable fees upfront.

Transparency in Costs

A notable feature of the Branch Loan App is its transparency. Borrowers receive a detailed breakdown of all costs associated with the loan, including interest and any penalties for late payment. There are no hidden fees, ensuring users can make informed decisions.

How to Apply for a Loan on Branch App

Step-by-Step Application Process

Applying for a loan on the Branch app is straightforward.

- Download and Install the App: The Branch Loan App is available for download on the Google Play Store or Apple App Store.

- Create an Account: New users must sign up using their phone number and verify their identity through a simple process.

- Link Bank Account or Mobile Wallet: Users are required to connect their active bank account or mobile wallet to facilitate loan disbursement and repayment.

- Select Loan Details: Borrowers can choose the loan amount and repayment tenure that suit their needs.

- Submit Application: Once the details are confirmed, users can submit the application and await approval.

Approval Process

Loan approval is typically quick, often taking only a few minutes to process. The app uses AI-driven credit scoring to evaluate the borrower’s eligibility based on smartphone data. Accuracy in providing information speeds up the process, and successful applicants receive funds in their linked accounts almost instantly.

User Experience

The Branch app offers a seamless user experience, with a simple interface designed for easy navigation. Notifications keep users updated on their application status, repayment schedules, and any promotional offers.

Advantages of Using Branch Loan App

Convenience

Branch eliminates the need for physical paperwork and lengthy approval processes. Users can access loans anytime and anywhere, making it a convenient option for emergencies or immediate financial needs.

Accessibility

The app is particularly beneficial for individuals who lack access to traditional banking services or credit facilities. Its reliance on alternative credit scoring methods, such as smartphone data, ensures inclusivity.

Flexibility

Borrowers can choose repayment schedules that align with their financial capacity, making it easier to manage repayments. Additionally, the app allows users to build their credit history within the platform, which can lead to increased loan limits over time.

Transparency

Branch is known for its transparent loan terms, with no hidden fees or charges. This clarity helps users make informed borrowing decisions, fostering trust in the platform.

Tips for Responsible Borrowing

Assessing Your Need

Before applying for a loan, it is crucial to determine whether borrowing is necessary. Loans should ideally be used for essential or productive purposes, such as medical emergencies or business investments.

Understanding Loan Costs

Borrowers must calculate the total repayment amount, including interest, to ensure affordability. The app provides a breakdown of costs, which can be used to make informed decisions.

Timely Repayments

Repaying loans on time not only avoids penalties but also improves the borrower’s creditworthiness. Setting reminders or automating repayments through the app can be helpful.

Avoiding Loan Dependency

While Branch offers a convenient financial solution, it is essential to use it as a supplementary tool rather than a primary source of funding. Borrowing responsibly ensures financial stability.

FAQs on Branch Loan App: Requirements, Interest, and Application

What are the basic requirements to apply for a loan on the Branch Loan App?

To apply for a loan, you must meet the following criteria:

- Be at least 18 years old and reside in a country where the app operates.

- Have an active bank account or mobile wallet linked to the app.

- Provide a valid government-issued ID and, in some cases, proof of income, such as bank statements or transaction history.

How does Branch determine interest rates for loans?

Branch uses an AI-driven system to assess your creditworthiness based on smartphone data, including your transaction history, app usage, and borrowing habits.

Interest rates typically range from 1.5% to 20% per month and vary depending on the loan amount, repayment duration, and your credit profile.

How long does it take to get a loan approved and disbursed?

Loan approval on the Branch Loan App is often instant, with most applications processed within minutes. Once approved, the loan amount is disbursed directly to your linked bank account or mobile wallet, making the process quick and seamless.

Conclusion

The Branch Loan App has emerged as a reliable and accessible platform for quick loans, particularly in regions where traditional banking services are limited.

By understanding the requirements, interest rates, and application process, borrowers can make informed decisions and leverage the app to meet their financial needs.

While the app’s convenience and transparency make it a valuable tool, responsible borrowing remains key to maximizing its benefits and avoiding financial strain. Ultimately, Branch exemplifies the potential of fintech to drive financial inclusion and empower individuals globally.

.